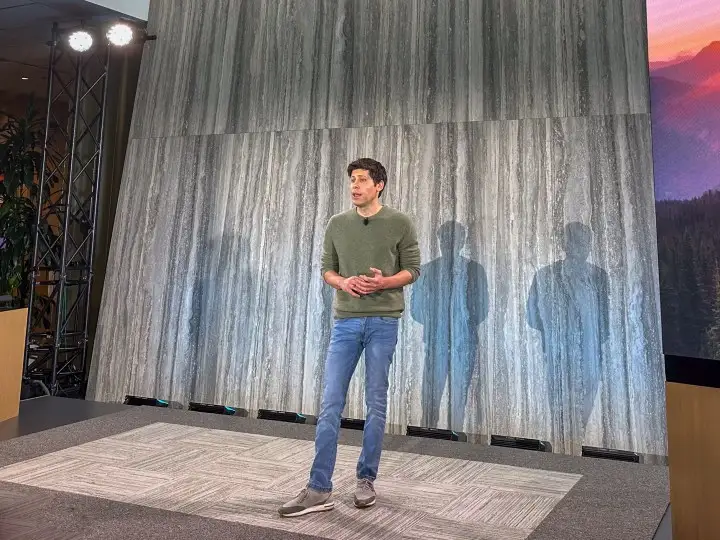

TSMC Snubs Sam Altman's $7 Trillion Chip Dream—Here's Why!

Despite the attention OpenAI CEO Sam Altman garners in Silicon Valley, the leadership at Taiwan Semiconductor Manufacturing Company (TSMC) seems less enthusiastic about his monumental aspirations. According to a report by the New York Times, TSMC executives mocked Altman as a "podcasting bro" and showed skepticism towards his ambitious $7 trillion initiative to establish 36 chip factories and AI data centers.

This critique follows Altman's unsuccessful public relations journey across Asian semiconductor giants, including Samsung and SK Hynix, in a bid to secure investments for OpenAI's hefty ambitions in the domain of artificial general intelligence.

Rumor has it that Altman's endeavor to gain chip production capabilities is part of a larger plan to position OpenAI as a formidable competitor to both Nvidia and TSMC. The proposed multi-trillion-dollar expenditure represents the scope of Altman's vision, which involves several years of construction to ramp up the fabrication capacity. Yet, TSMC leaders are vocal about concerns over the economic implications and viability of this vision.

TSMC's critical stance isn't unprecedented. During their 2024 Annual Shareholders Meeting, TSMC's founder, Dr. C. C. Wei, expressed disbelief at Altman's intense approach, citing it as "too aggressive to be convincing." Nevertheless, OpenAI's allure for investors persists, with a whopping $13 billion investment from Microsoft in 2023, plus an additional funding round of $6.5 billion anticipated to conclude soon.

While OpenAI's estimated $4 billion annual revenue appears impressive, the company seems to be burning through nearly double that amount annually at $7 billion. The Wall Street Journal highlights this discrepancy, noting management instability as several top figures, including CTO Mira Murati and Chief Revenue Officer Bob McGrew, recently departed.

To make itself more palatable to investors, OpenAI is rumored to be strategizing a shift from a nonprofit to a for-profit entity. This move potentially underscores Altman's strategic acumen in the increasingly competitive AI landscape. Such a shift could attract new investment partners willing to ride the wave of AI's future potential, despite the current financial hemorrhage.